After COVID – Innovation in a time of crisis

The COVID-19 crisis has severely disrupted every industry. Alongside the tragic human toll there have been considerable economic impacts. Strengths and weaknesses have been put under a spotlight and we have all been challenged to rethink the ways in which we do business and consider more carefully the areas in which we fall short.

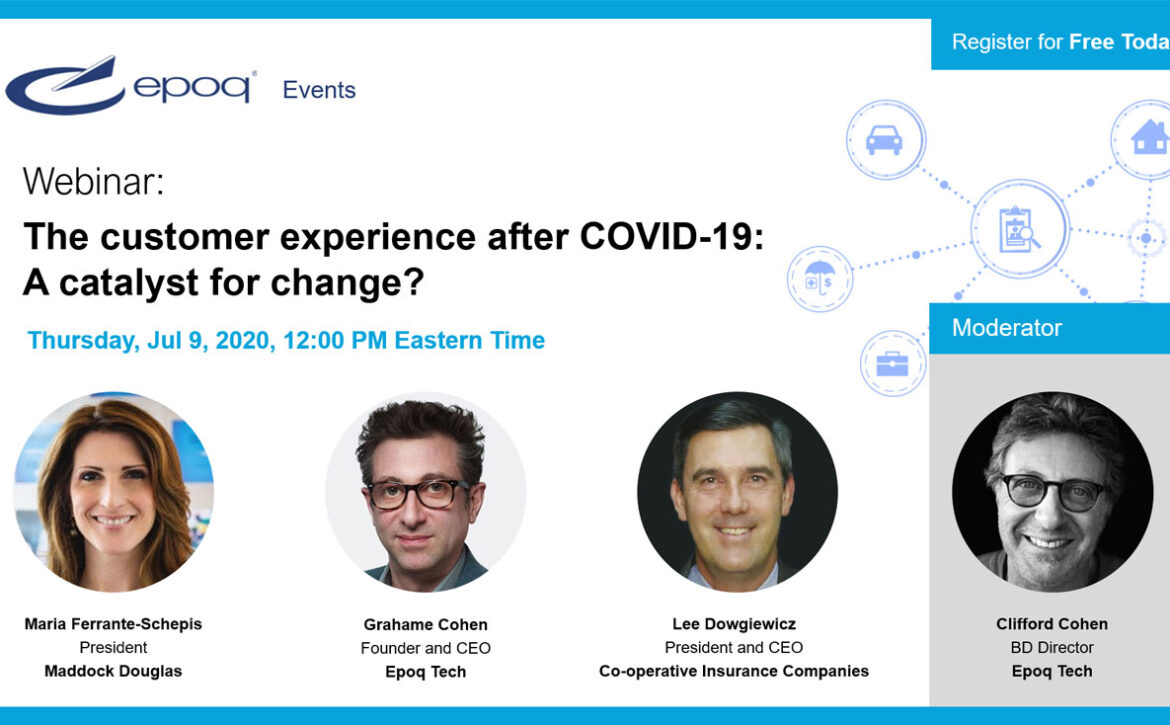

Webinar video – The customer experience after COVID-19: A catalyst for change?

Thankyou to all those who were able to attend our webinar on July 9th. We hope you found it interesting and engaging. If you weren’t able to attend then you can watch our recording of the event.

Webinar : The customer experience after COVID-19: A catalyst for change?

The COVID-19 pandemic has had a profound effect on the economy and entangled itself into many facets of our personal and professional lives. Although the full effects are still unknown, the impact on the insurance industry will likely be far reaching. Necessity is the mother of invention. In the past, such crises have generated a lot of energy that has forced the reshaping of markets and spurred innovation. The crisis has put strengths and weaknesses under a spotlight and may challenge providers to rethink their assumptions and address their points of failure.

Life cover should go beyond the policy

As online sales of life insurance soar due to COVID-19, the industry questions whether the surge will continue after the global pandemic. What this spike demonstrates is that there has never been a more pressing time to get our affairs in order. But while life insurance is vital in today’s world, many do not consider the product a necessary expense. This is our moment to educate customers on the importance of life and annuity services and to impress upon providers the importance of adjusting business operations to meet new customer behaviors.

For every life there is a beginning and an end. It’s inevitable for us all.

Throughout the time in between we expand our families, invest in property, take out private pensions, save… and the list goes on. And for every milestone in our lifecycle there is a need to plan for what happens to ourselves and our families should the worst come to pass. Estate planning services – Wills, Powers of Attorney and Healthcare Directives – are essential for everyone.

In a recent survey by the Life Insurance Marketing and Research Association (LIMRA) on how COVID-19 is affecting life insurance[1] in the US, results showed that there was a shift in how consumers applied for policies, A quarter of respondents reported an increase in online applications and twenty-four percent of companies with online services experienced an increase in applications.

[1] https://www.limra.com/en/newsroom/industry-trends/2020/limra-how-covid-19-is-affecting-life-insurance-in-the-u.s.-and-canada/

Regrettably, life insurance sales are usually slow and the struggle to capture an evolving market continues. Hyper-connected, digital-savvy millennials have replaced previous generations as the primary buyers of insurance and because they are constantly connected they expect immediate responses and gratification, so insurers are looking for new ways to turn business around and meet these changing consumer needs.

The market is no longer settling for the status quo. Customers want to be engaged with. They want to hear from insurers more frequently with personalized touchpoints and cover options; but above all, they want feedback fast and applications to be easy.

Enter the technological revolution. In this age of technology and abundant innovation, traditional insurance models need a serious revamp. It’s time to add services and tools that go beyond claims but rather extend the customer experience and increase the perceived value of their package.

Once seen as out of reach; technology such as Artificial Intelligence, machine learning, blockchain and gamification are becoming part and parcel of business infrastructure and customer service. Adding a technological component to a traditional insurance package will ultimately mitigate risks, cost less and be accessible anytime, anywhere. But not only does this appeal to customers, it can also play a significant role in operational efficacy for insurers.

Across many customer surveys over the past few years, customers have remarked that they would be more likely to purchase a life insurance policy if the insurer offered benefits such as loyalty programs, wellness rewards, cash back, additional coverage and lower premiums. It is now that life insurers should be responding to shifting market dynamics.

Digital legal document preparation is yet another example of an insurtech ‘allied service’ that adds a top layer to the traditional insurance model and increases the value of a life insurance policy. Insurers already have open dialogue with customers centred around planning for the future and protecting families. Estate planning and its accompanying documents are closely aligned with this and can form an essential part of the life offering.

With Epoq’s logic-driven automated document system, insurers can offer life customers a quick and easy way to make a Will or Power of Attorney from the comfort of their own homes as the platform is conveniently accessible online across a range of devices. Essentially, the document software makes the process of creating complex legal documents quick, easy, consistent and affordable. On the left panel of the screen customers will find a series of logic driven questions, the answers to which determines the next set of questions. As these questions are answered the document drafts in real time on the right panel where clauses are inserted, removed or altered resulting in a document that is completely tailored to the end users’ needs. These documents are then stored securely online for easy management and access.

To provide two examples of companies offering Epoq’s digital document service to their policyholders:

- Mutual of Omaha recently introduced a digital Wills and estate planning service for their life insurance customers

- Foresters have announced they are offering a digital estate planning service for their members in three countries simultaneously (U.S.A, Canada and the U.K)

Future-proofing business with modern applications reduces the reliance on legacy systems and business models that are no longer performing. This does not mean that you have to work harder. It means working smarter and more efficiently with the introduction of insurtech elements that will work for your business whilst meeting the needs of an evolving group of consumers.

Responding to shifting market dynamics, the key is to view technologies and concepts that will push the industry forward as essential. Next-generation insurers should do well whereas legacy-minded insurance companies will need to adapt to stay abreast of their competitors. Start now by making it easier for consumers to apply for a policy under very unusual circumstances.

How technology is re-engineering the policyholder experience

Millennials are replacing the boomers as the largest consumer group and insurers have some catching up to do. This may involve facing up to some of the underlying challenges facing the industry and rethinking the traditional insurance model for the next generation of policyholders

Insurance is an intangible product and its value is difficult for the average consumer to process. Common perceptions are that insurance is expensive, complicated and a grudge purchase. The only time the policyholder sees value is when they’re making a claim which could be years after taking out the policy (and possibly not at all). In the meantime, the policyholder is left uncertain as to the value of the coverage they have purchased.

These are longstanding problems for traditional insurance. Millennials complicate the picture by posing challenges in other areas of product and service delivery. Research shows the new generation of consumers want personalization, simplicity, instant delivery and pro-active engagement. They are price sensitive, lack brand loyalty and expect customer centric-innovation. Providers must look to reenergize the traditional model of insurance if they want to engage their biggest potential customer base.

Some in the industry are making use of InsurTech services that support more pro-active policyholder engagement strategies and improve the customer experience. These could be divided into two categories.

The first are services that modernize the existing components of a typical insurance product. An example of this type of approach is Hi Marley an AI-enabled conversation platform that connects insurance carriers and their end-customers via texts for underwriting and policy interactions. This component has been recently adopted by Encova and AON to address the fact that the next generation prefers messaging to phone calls. Introducing this type of AI will improve response times. Elsewhere companies are improving their claims procedures with platforms like Claim Technology’s AI powered bot Robin. These aim to make the process easier, faster and cheaper.

The second category are customer facing allied services that seek to augment insurance by serving more of the policyholder’s needs. These tools extend the scope of insurance, providing “day-one value” to customers that goes beyond making an infrequent claim. Much of the running here has been made by new entrants to the market.

An example is Figo which aims to make pet insurance a more expansive product. It does so by providing a “pet cloud” that stores an individual’s pet files in one place, provides access to a live vet 24/7, and connects pet owners to each other and pet friendly places.

Elsewhere in the market Metromile’s auto insurance includes a similar platform that allows users to view their trip history, understand their car’s health, avoid tickets and find their stolen or parked car.

Cyber providers like Paladin are building risk assessment and security tools into their small business insurance. In this way they are providing additional protection to their insureds that also helps to mitigate the risks they are covering.

At Epoq we have made a similar contribution by helping a number of mutuals to offer legal services alongside their policies. Our technology platform has been used to include suites of wills and estate planning services for homeowners’ policies and lease agreements and deposit notices for books of habitational risk. We have also helped to augment and provide a risk mitigation component to small business insurance with services that help groups like contractors transfer risk and protect themselves with legal agreements. Legal services and insurance are complimentary in that they both focus on planning for the future and managing risk. Technology has now changed the economics of delivering law so that it can now feasibly be delivered as a “value-add” that improves the customer experience. Doing so helps groups that have traditionally been priced out of the legal services market to protect their families, businesses and assets.

Insurers are beginning to make progress in re-engineering the policyholder experience but where will this trend go in the future? Clearly there is scope to expand the reach of insurance by assembling services that can be embedded or sold to generate non-risk income. These might include personal budgeting and lifestyle management tools, legal services and risk management solutions, customer conversation platforms and smart home technology. Rather than mere gimmicks, such components act as a “top layer” for the underlying insurance from which the policyholder can derive instant benefits. This helps correct the perception among consumers that the insurance they carry is of uncertain value. It provides an additional incentive for customers retain a policy in a market where products are vanilla and differentiation is difficult.

Millennials are the first generation of digital natives and their affinity for technology is poised to reshape the economy and the way business is conducted. This presents an opportunity to re-energize the traditional insurance model for the 21st century. A strategy focused on providing a quality experience will be critical for differentiation and driving growth by acquiring the next generation of policyholders.