After COVID – Innovation in a time of crisis

The COVID-19 crisis has severely disrupted every industry. Alongside the tragic human toll there have been considerable economic impacts. Strengths and weaknesses have been put under a spotlight and we have all been challenged to rethink the ways in which we do business and consider more carefully the areas in which we fall short.

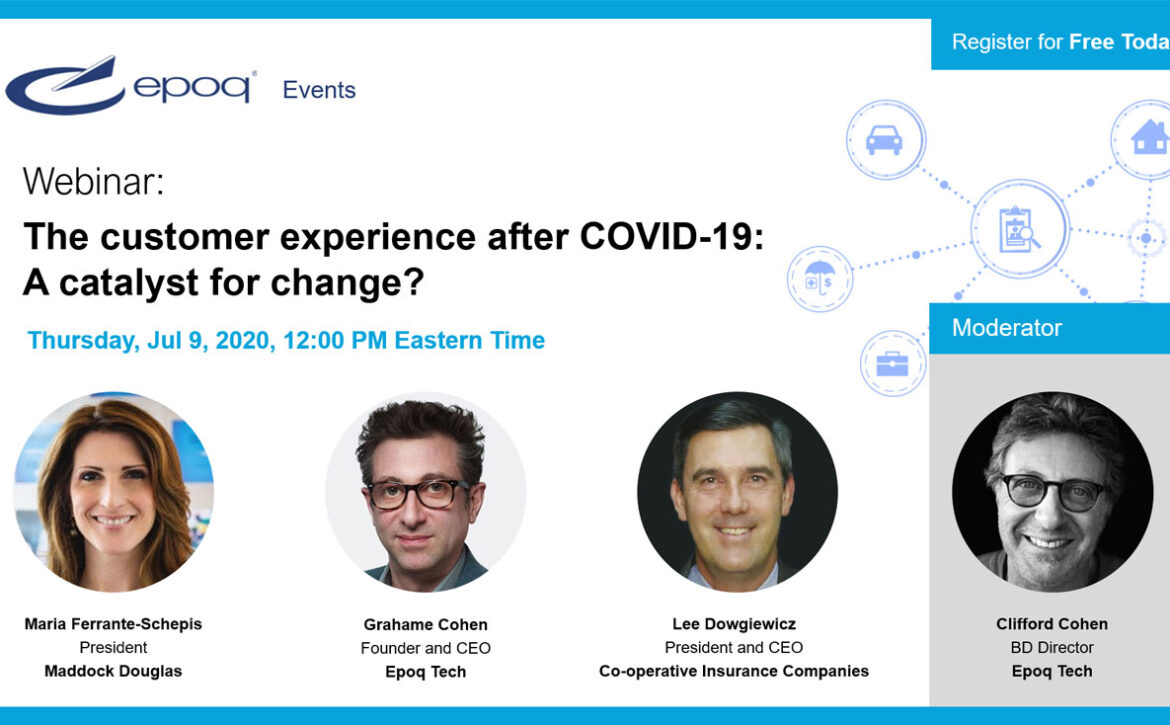

Webinar video – The customer experience after COVID-19: A catalyst for change?

Thankyou to all those who were able to attend our webinar on July 9th. We hope you found it interesting and engaging. If you weren’t able to attend then you can watch our recording of the event.

How technology is re-engineering the policyholder experience

Millennials are replacing the boomers as the largest consumer group and insurers have some catching up to do. This may involve facing up to some of the underlying challenges facing the industry and rethinking the traditional insurance model for the next generation of policyholders

Insurance is an intangible product and its value is difficult for the average consumer to process. Common perceptions are that insurance is expensive, complicated and a grudge purchase. The only time the policyholder sees value is when they’re making a claim which could be years after taking out the policy (and possibly not at all). In the meantime, the policyholder is left uncertain as to the value of the coverage they have purchased.

These are longstanding problems for traditional insurance. Millennials complicate the picture by posing challenges in other areas of product and service delivery. Research shows the new generation of consumers want personalization, simplicity, instant delivery and pro-active engagement. They are price sensitive, lack brand loyalty and expect customer centric-innovation. Providers must look to reenergize the traditional model of insurance if they want to engage their biggest potential customer base.

Some in the industry are making use of InsurTech services that support more pro-active policyholder engagement strategies and improve the customer experience. These could be divided into two categories.

The first are services that modernize the existing components of a typical insurance product. An example of this type of approach is Hi Marley an AI-enabled conversation platform that connects insurance carriers and their end-customers via texts for underwriting and policy interactions. This component has been recently adopted by Encova and AON to address the fact that the next generation prefers messaging to phone calls. Introducing this type of AI will improve response times. Elsewhere companies are improving their claims procedures with platforms like Claim Technology’s AI powered bot Robin. These aim to make the process easier, faster and cheaper.

The second category are customer facing allied services that seek to augment insurance by serving more of the policyholder’s needs. These tools extend the scope of insurance, providing “day-one value” to customers that goes beyond making an infrequent claim. Much of the running here has been made by new entrants to the market.

An example is Figo which aims to make pet insurance a more expansive product. It does so by providing a “pet cloud” that stores an individual’s pet files in one place, provides access to a live vet 24/7, and connects pet owners to each other and pet friendly places.

Elsewhere in the market Metromile’s auto insurance includes a similar platform that allows users to view their trip history, understand their car’s health, avoid tickets and find their stolen or parked car.

Cyber providers like Paladin are building risk assessment and security tools into their small business insurance. In this way they are providing additional protection to their insureds that also helps to mitigate the risks they are covering.

At Epoq we have made a similar contribution by helping a number of mutuals to offer legal services alongside their policies. Our technology platform has been used to include suites of wills and estate planning services for homeowners’ policies and lease agreements and deposit notices for books of habitational risk. We have also helped to augment and provide a risk mitigation component to small business insurance with services that help groups like contractors transfer risk and protect themselves with legal agreements. Legal services and insurance are complimentary in that they both focus on planning for the future and managing risk. Technology has now changed the economics of delivering law so that it can now feasibly be delivered as a “value-add” that improves the customer experience. Doing so helps groups that have traditionally been priced out of the legal services market to protect their families, businesses and assets.

Insurers are beginning to make progress in re-engineering the policyholder experience but where will this trend go in the future? Clearly there is scope to expand the reach of insurance by assembling services that can be embedded or sold to generate non-risk income. These might include personal budgeting and lifestyle management tools, legal services and risk management solutions, customer conversation platforms and smart home technology. Rather than mere gimmicks, such components act as a “top layer” for the underlying insurance from which the policyholder can derive instant benefits. This helps correct the perception among consumers that the insurance they carry is of uncertain value. It provides an additional incentive for customers retain a policy in a market where products are vanilla and differentiation is difficult.

Millennials are the first generation of digital natives and their affinity for technology is poised to reshape the economy and the way business is conducted. This presents an opportunity to re-energize the traditional insurance model for the 21st century. A strategy focused on providing a quality experience will be critical for differentiation and driving growth by acquiring the next generation of policyholders.