What’s stopping innovation in the surplus lines insurance market?

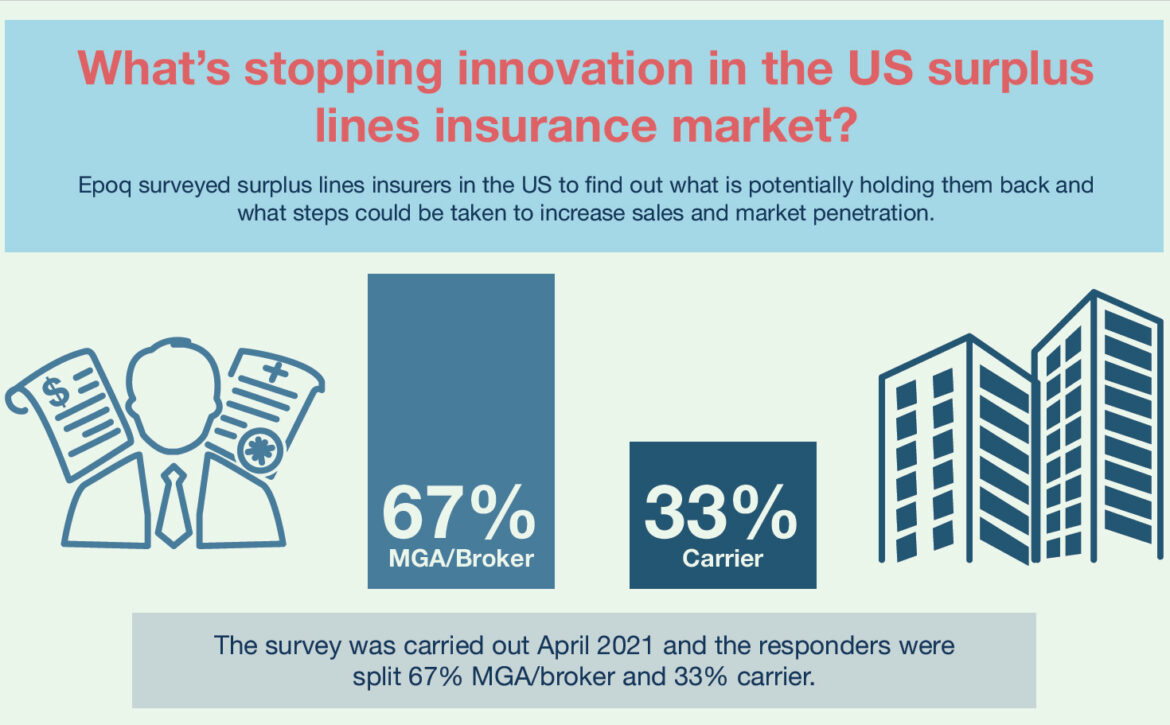

Epoq surveyed surplus lines insurers in the U.S. to find out what is potentially holding them back and what steps could be taken to increase sales and market penetration.

To see the results as an infographic, click on the button below.

The survey revealed the key perceived threats to surplus lines insurer’s development and success were:

- growth in new competitive innovative insurance products

- increased competition from new entrants

- meeting the changing expectations of millennials

When asked to rate the importance of four strategic priorities to help grow their business, the most highly rated were:

- improving policyholder retention and providing digital services to policyholders (82% rating very or extremely important), followed by:

- improving policyholder engagement and implementing value-add services (62% rating very or extremely important).

The extent to which surplus lines insurers are taking the issues facing their growth seriously was revealed when 100% of responders said their organization had actively taken steps to address one or more of them over the past two years.

However, despite this obvious awareness and desire to improve, 100% of responders reported barriers or roadblocks in their attempts to innovate. When asked what the barriers were, as follows:

- fragmented decision making or decision fatigue (75%)

- resistance to change within the organization (58%)

- insufficient funds to implement changes (50%)

It appears therefore that, whilst surplus lines insurers have a high level of awareness and understanding of the issues affecting the growth of their businesses, they are experiencing barriers to their attempts to innovate, improve customer retention and increase market penetration.